free cash flow yield private equity

The Financials sector FCF rose from 757 billion in 2020 to. Ad For Private Companies Who Want Equity Plans Done Right.

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Cash flows refer to the cash generated in the business during a specific time period after meeting all business obligations.

. Ad Connect Global Financial Market Data Turn Insight into Action. The bull case here is pretty straightforward. In the first quarter of 2022 Crestwood Equity Partners reported a distributable cash flow of 1167 million but only paid out 642 million to the common unitholders.

Since FCFE is intended to reflect the cash flows that go only to equity holders there is no need to add back. LFCF yield is calculated as levered free cash flow divided by the value of equity. Thats the ratio of free cash flow to market cap.

Figure 1 shows trailing FCF yield for the Financials sector rose from 12 as of 33121 to 40 as of 31122. Equity Valuation Free Cash Flow and Other Valuation Models T his study session presents additional valuation methods for estimating a companys intrinsic value. In corporate finance free cash flow to equity FCFE is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacksafter all.

FCFE Net Income DA Change in NWC CapEx Net Borrowing. More than 40 years of experience specializing in alternative asset investing. This cash flow is often referred to as free cash flow indicating that.

Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the. Ad More than 40 years of specialized investment experience in alternative assets. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to.

Ad Customizable options contract that cross margin the same underlying stock or index. The equity multiple is defined as the total cash distributions received from an investment divided by the total equity invested. Connect with FactSets Research Solutions to Build Custom Financial Market Data Models.

Ad Public Fixed Income Private Placement Debt Real Estate. The free cash flow. Learn more about MetLife Investment Management.

Here is the equity multiple formula. Ad For Private Companies Who Want Equity Plans Done Right. Management has guided for 28-33 billion in 2022 EBITDA with free cash flow before growth of between 21 billion and 26.

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Calculator

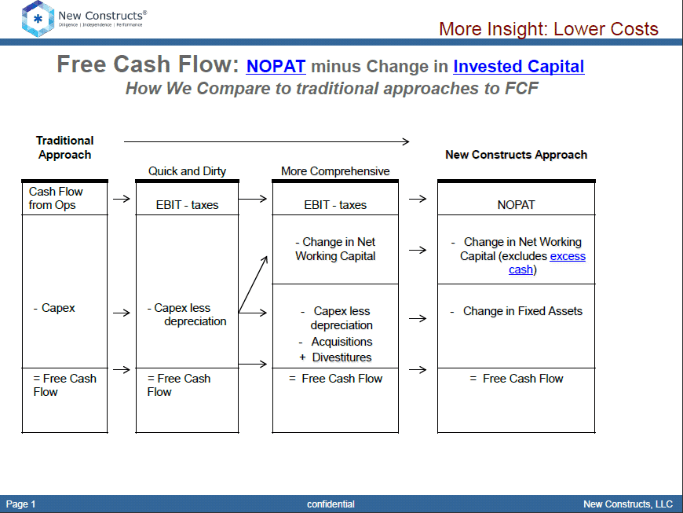

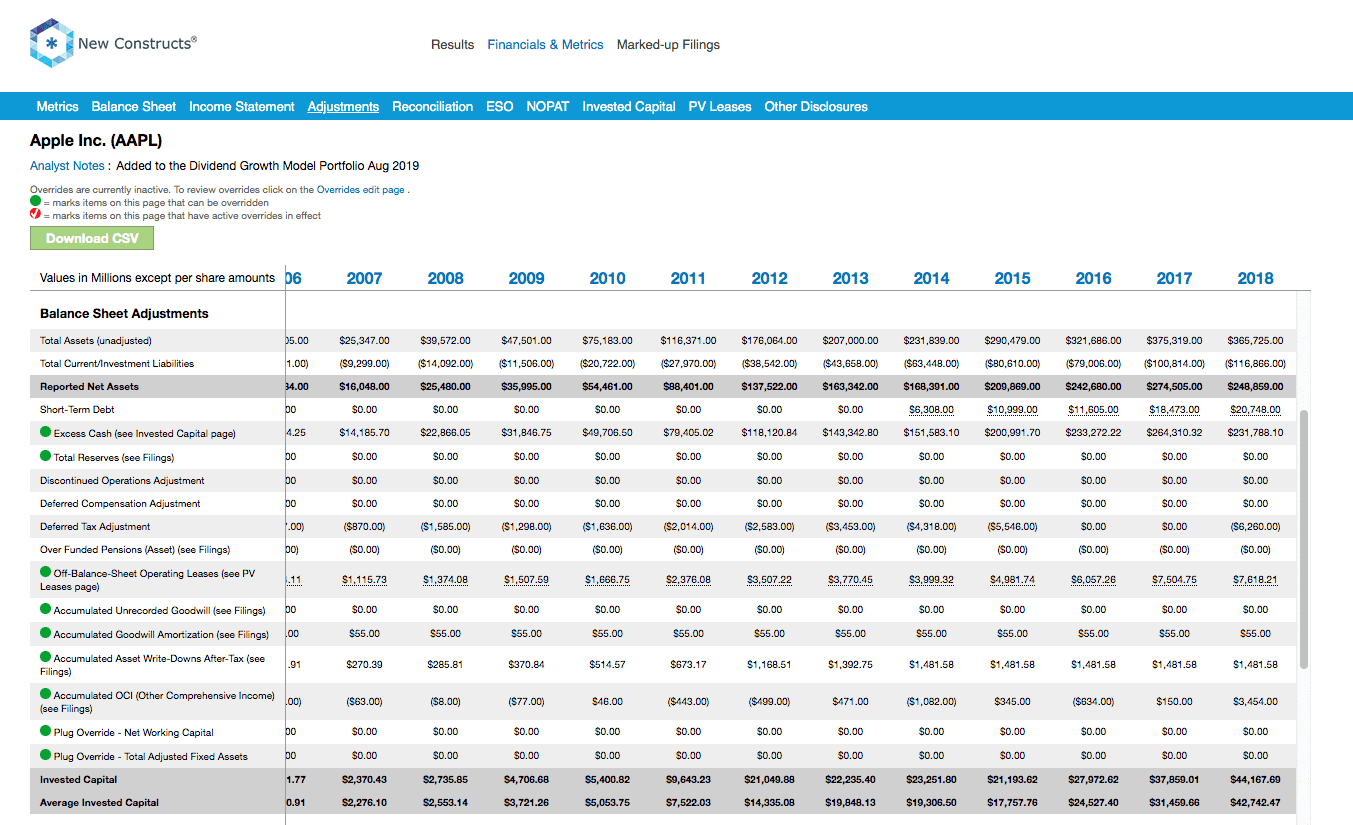

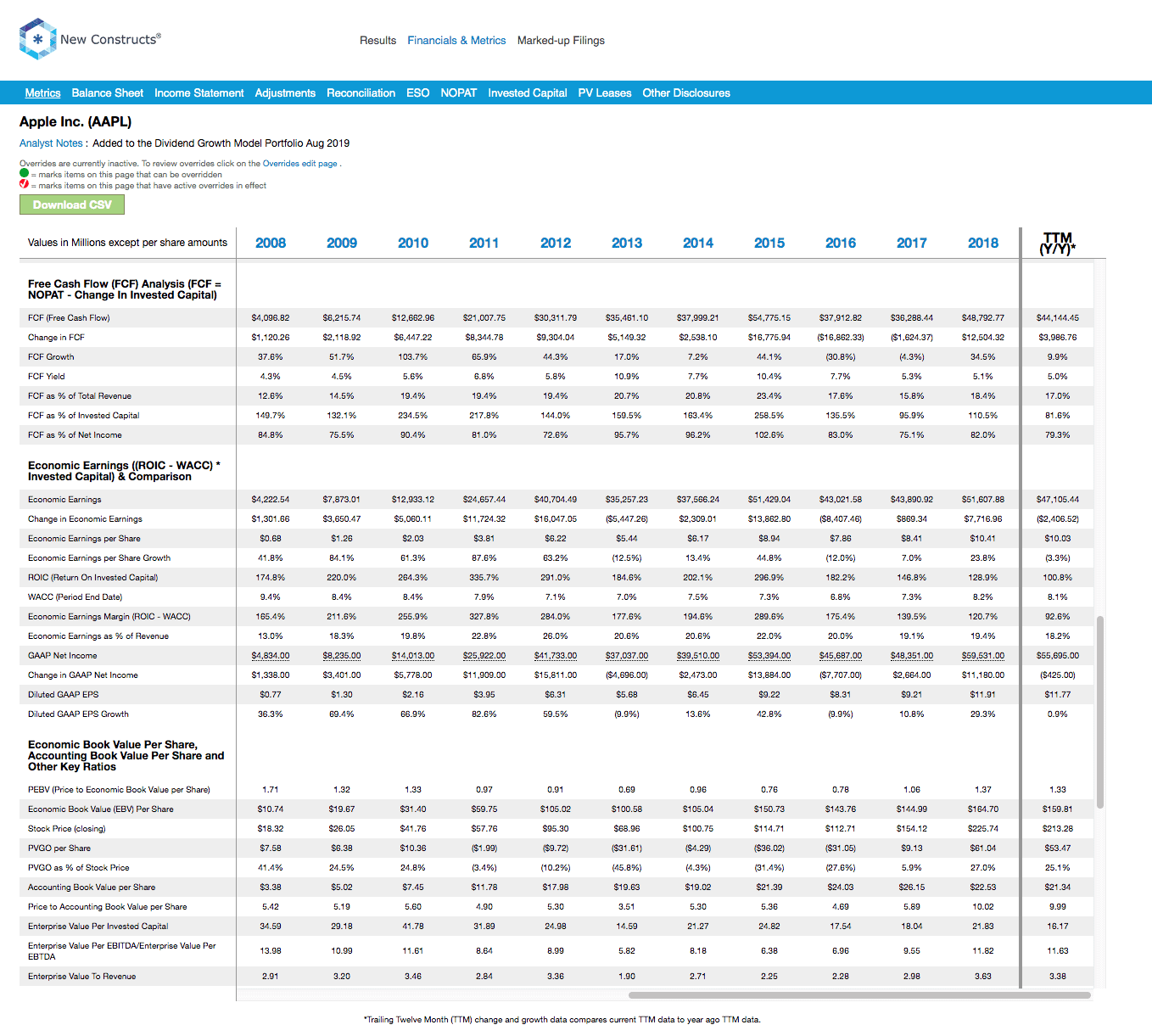

Education Metrics Fcf New Constructs

Education Metrics Fcf New Constructs

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Education Metrics Fcf New Constructs

Fcf Yield Unlevered Vs Levered Formula And Calculator

/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

All Cap Index Sectors Free Cash Flow Yield Near Record Highs Through 5 16 22

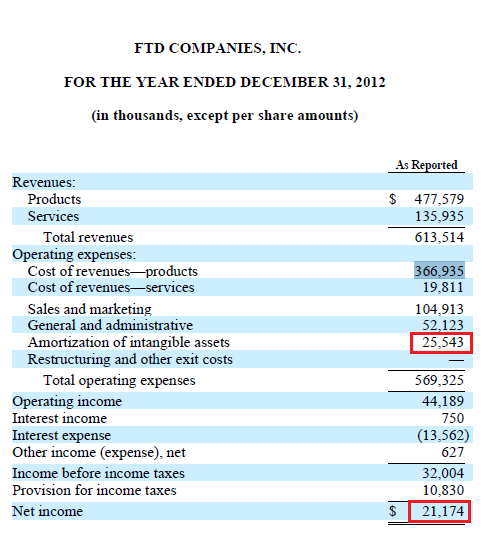

Ftd Companies A Free Cash Flow Monster With 50 Upside Nasdaq Ftd Seeking Alpha

How To Calculate Free Cash Flow Excel Examples

Education Metrics Fcf New Constructs

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Explained

All Cap Index Sectors Free Cash Flow Yield Near Record Highs Through 5 16 22